Not known Details About Thomas Insurance Advisors

Wiki Article

Fascination About Thomas Insurance Advisors

Table of Contents3 Simple Techniques For Thomas Insurance AdvisorsThomas Insurance Advisors for BeginnersThe 9-Second Trick For Thomas Insurance AdvisorsThe Definitive Guide to Thomas Insurance Advisors

We can not stop the unexpected from occurring, however sometimes we can secure ourselves and our family members from the worst of the financial after effects. 4 types of insurance that the majority of monetary specialists recommend include life, wellness, auto, as well as lasting disability.Wellness insurance policy protects you from devastating expenses in instance of a serious accident or ailment. Car insurance prevents you from bearing the monetary concern of a pricey mishap.

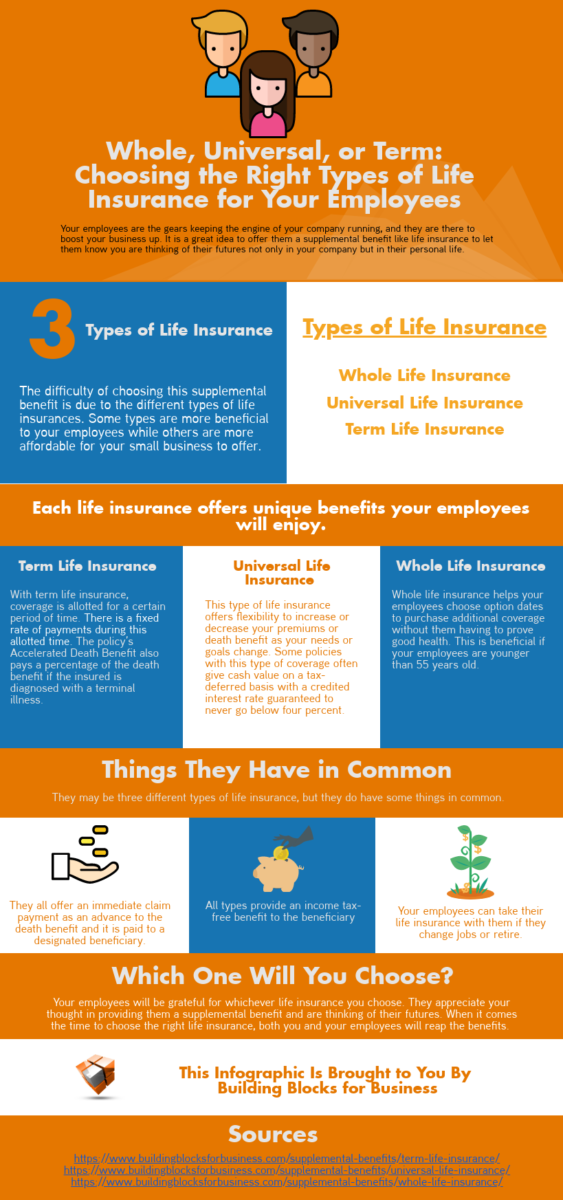

It consists of a death benefit and additionally a cash value part.

Excitement About Thomas Insurance Advisors

Bureau of Labor Data, both spouses worked as well as brought in income in 48. Life Insurance in Toccoa, GA. 9% of married-couple family members in 2022. This is up from 46. 8% in 2021. They would certainly be likely to experience economic challenge as an outcome of one of their breadwinner' deaths. Health insurance policy can be gotten through your employer, the government medical insurance industry, or exclusive insurance you buy for on your own as well as your family members by getting in touch with medical insurance companies directly or going via a medical insurance agent.

If your revenue is reduced, you may be among the 80 million Americans that are qualified for Medicaid. If your revenue is moderate but doesn't extend to insurance protection, you might be eligible for subsidized insurance coverage under the federal Affordable Treatment Act. The best as well as least pricey option for employed staff members is typically joining your company's insurance coverage program if your company has one.

Investopedia/ Jake Shi Long-lasting special needs insurance sustains those that become incapable to function. According to the Social Security Management, one in 4 workers entering the workforce will become impaired before they get to the age of retirement. While health insurance coverage spends for hospitalization and clinical bills, you Full Report are commonly strained with all of the expenditures that your paycheck had covered.

The Only Guide for Thomas Insurance Advisors

Many plans pay 40% to 70% of your earnings. The expense of impairment insurance coverage is based on several factors, consisting of age, lifestyle, and also health and wellness.Many plans call for a three-month waiting duration prior to the protection kicks in, provide an optimum of three years' well worth of insurance coverage, and have considerable plan exemptions. Right here are your alternatives when buying automobile insurance coverage: Liability coverage: Pays for property damages as well as injuries you create to others if you're at mistake for an accident and also covers lawsuits prices as well as judgments or settlements if you're taken legal action against since of an auto crash.

Comprehensive insurance coverage covers burglary and also damages to your vehicle as a result of floodings, hailstorm, fire, vandalism, falling objects, and also pet strikes. When you fund your auto or lease an automobile, this kind of insurance coverage is compulsory. Uninsured/underinsured motorist () insurance coverage: If a without insurance or underinsured vehicle driver strikes your car, this protection pays for you as well as your guest's clinical expenses and also may also account for lost income or make up for discomfort and also suffering.

Little Known Questions About Thomas Insurance Advisors.

Medical payment insurance coverage: Medication, Pay insurance coverage helps spend for medical costs, normally in between $1,000 as well as $5,000 for you and also your passengers if you're harmed in a crash. Just like all insurance, your circumstances will certainly determine the price. Compare numerous price quotes and also the coverage given, and also inspect regularly to see if you qualify for a lower price based on your age, driving document, or the area where you live.Employer insurance coverage is often the finest choice, yet if that is not available, get quotes from several providers as lots of give discount rates if you acquire more than one sort of coverage.

There are several different insurance plan, as well as knowing which is ideal for you can be challenging. This guide will certainly discuss the various kinds of insurance as well as what they cover. We will certainly also give suggestions on choosing the best policy for your demands. Table Of Material Medical insurance is just one of the most essential sorts of insurance that you can have.

Depending on the plan, it can also cover dental and vision care. When selecting a medical insurance plan, you need to consider your details requirements and the degree of insurance coverage you call for. Life insurance policy is a plan that pays out an amount to your recipients when you die. It provides economic security for your enjoyed ones if you can not sustain them.

Report this wiki page